A transaction is a short journey between you and your supplier or vendor. Sometimes, you might face certain difficulties while paying from your business account to your vendor due to various issues. And even if there’s no difficulty, it takes lots of time and effort to manage so many invoices and track transactions manually, plus the chance of human error is always there. But if you automate your company’s payable process using account payable (AP) tools, you can better plan and keep track of every transaction so that you never miss a THANKS. You can refer to the accounts payable (AP) as a short, live record of your transactions. An advanced account payable automation tool is built to make your life easier by automating your manual work and help run your business smoothly. Many successful businesses have AP automation software that handles a huge amount of transactions between accounting firms and suppliers. So, let’s start with what accounts payable automation software is all about and how it can help you.

What is Automated Accounts Payable Software?

Automated Accounts Payable software is a tool that handles your financial transaction from the beginning to the end. Whenever you receive invoices and bills, you must be aware of clearing all the amounts within the given period. But, when you are doing all this manually, there are many errors and issues that you may face. Due to this, your reputation may be at stake, and suppliers or vendors may not put their trust in you from the next payment. The automation software helps pay your bill on time from your business account through ACH payments, credit cards, or check payments. AP automation tool digitizes the supplier/vendor invoice and bill process to create leaner, cost-effective, and faster workflows. Thus, no manual forwardings, no cutting paper checks, and no paper receipts anymore.

Why do companies use automated Accounts Payable Tool?

There are multiple benefits of using cash flow automation. It will reduce the risk of errors, enhance efficiency, build greater bonds with suppliers, and improve the quality of workflow. So, let’s understand how automated accounts payable brings success and prosperity to your business.

Streamlines Transactions

Debt is an overhead for individuals and businesses. With manual entry, you may forget some of the invoices. You need to take control over the whole transaction without missing any single invoice. This way, you improve your cash flow and enhance your growth.

Financial Forecasts

Automated AP software generates smarter data that is not going to come with manual cash flow. It collects data and assists you with the right insights so that you know what is happening in your cash cycle. With the correct insights, you can make smarter decisions for your business.

Cash Flow Visibility

The accounts payable department plays an important role in the company’s automated cash flow management. With automation, you can improve the visibility of your accounts and maintain your accounts payable software through the records you have in your dashboard.

Less Processing Fees

Manual cash flow takes a long time for your financial team. The company generally pays on time, but due to heavy tasks, sometimes they pay late, which results in an extra charge. The automation software looks into all the processes thoroughly so that you can speed up your invoice processing. You can also save transaction fees as some of the software have reward options for every payment you make. Thus, AP automation software saves time, improves accuracy, enhances insight and transparency, saves unnecessary expenses, offers fraud detection, low-cost data preservation, easy auditing, early payment discounts, and integrates with existing accounting software. Next, let’s explore some good AP software that can give you the flexibility of making payments.

Bill.com

Give more time to your strategy by eliminating paperwork with Bill.com. It offers a smart way to send invoices, create and pay bills, and get paid. Whether you are a small business, midsize company, or large accounting firm, Bill.com provides you with a better approach to getting paid immediately. Clean up the mess of your payables and gain a complete view of the entire accounts payable process. Control the simple process with end-to-end automation, turn your paper-based payables into digital paper, and capture all the invoices from your email under one roof. Bill.com allows you to customize the approval policies, approve bills from any place, and automate approval workflows with a simple swipe or a few steps. It offers a variety of payment options, including credit cards, cheques, international wire, ePayments, and more. See everything from coming payments to going payments with a dashboard view that allows you to track every stat. Direct data integration or two-way sync with the accounting software to eliminate manual entry, resulting in saving your time and effort. Start your risk-free trial and automate your accounts payable process from the beginning.

Melio

Simplify your invoice process, enhance your cash flow with Melio and enjoy a flexible payment method. Choose to pay with your card (2.9% fee) or ACH bank transfer for free and eliminate heavy paperwork. You can pay any invoice and business expense online, and vendors get an instant direct deposit to their account or a paper check without signing up. You can process multiple payments at once, save your time with Melio and collect reward points while paying by credit card. Set approval workflows to decide everyone’s role and responsibilities toward the payment permissions. Directly pay your business bills from anywhere at any time and from any device, and you can even make international payments without hassle. Sync your accounting software with FreshBooks, QuickBooks, and more to simplify taxes and bookkeeping. Moreover, you can split your bills into various payment methods and payments for flexibility. You just need to create an account, upload the bill or invoice, make payment, and choose how your vendors get paid. Start now and use your time to make strategies rather than managing invoices manually.

Tipalti

Transform your way of working with the Tipalti smart account payable tool. It brings efficiency and scalability to your business through fully automated and end-to-end solutions so that you can focus on your business growth while Tipalti takes care of the rest. Tipalti is built to support every step of your payable cycle. Using the tool, you can eliminate 80% of the workload, close 25% faster financially, and reduce 66% of the payment errors. Modernize the financial operations by freeing your finance teams from the daily inefficiencies due to the manual payable process. Get complete control and visibility of your business and experience efficiency in every account. No need to add any further resources; scale rapidly with the Tipalti AP automation tool and strengthen your financial controls to reduce compliance risk. The tool offers real-time insight, can reduce your workload from manual invoicing, and go for a touchless invoice solution with advanced approvals, PO matching, and machine learning technology. In addition, execute the payments in a variety of methods and currencies across the globe. Easily manage payment approvals, detect frauds, and make instant payments without hassle. Ensure global compliance and operations across all the subsidiaries and entities with an HQ view. Tipalti also provides enterprise-grade financial controls and ensures compliance with KPMG-approved tax engines. Reduce the payment risk by using the tool. Book a short demo to know more.

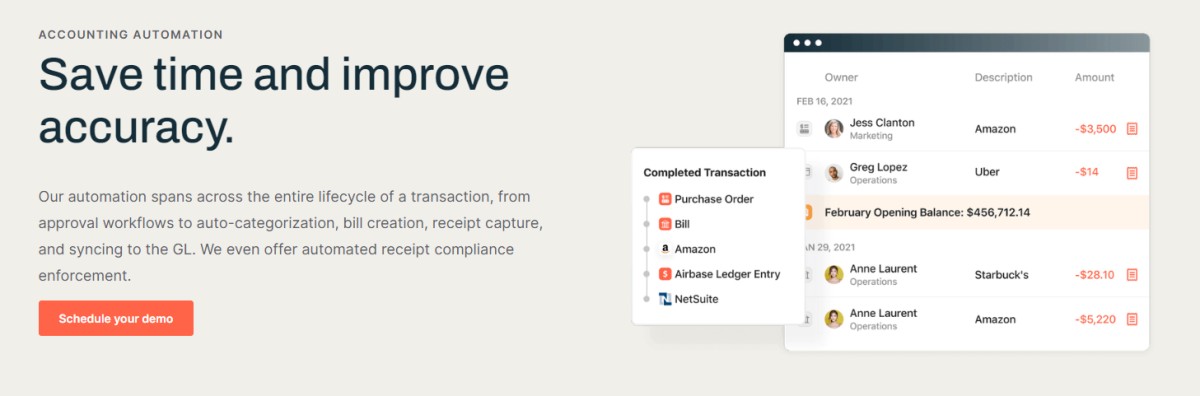

Airbase

Improve accuracy and save your time with Airbase’s Accounting Automation. Its automation spans the whole lifecycle of transactions, from approval to auto-categorization, receipt capture, bill creation, and syncing to the GL. It also offers automated receipt compliance enforcement. Airbase integrates with Xero, QuickBooks Desktop, QuickBooks Online, Oracle NetSuite, and Sage Intacct so that it can sync virtual cards to your GL automatically during the transaction. The other transactions can easily be synced to the GL after a single payment. You can set settings and rules according to your preferences. Airbase recommends fields in your next transaction as it learns from your first transaction. Thus, it will get intelligent after every sync. In addition, the auto-categorization updates your GL fields of the physical card transactions based on your past entries. It also updates the ledger field for the category, line tags, transaction tags, and vendor. Set your contract start and end dates for amortization schedules. If you are a NetSuite user, you can take advantage of the deep integrations by choosing from various amortization templates for complex flows. So, automate your low-value task and start focusing on the high-value strategic ways.

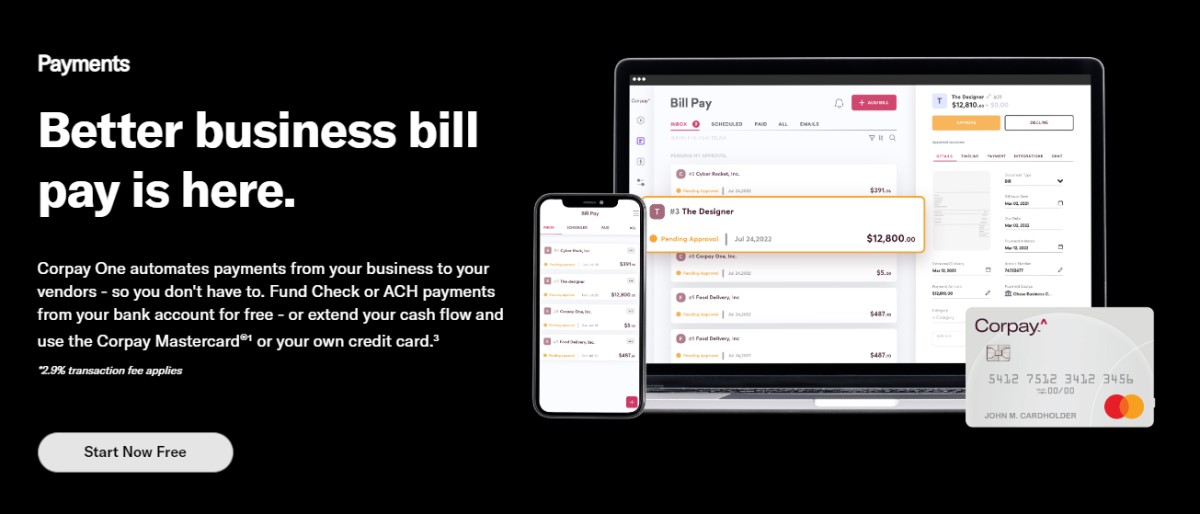

Corpay One

Pay your business bill easily with Corpay One, which automates the payment processes from your business account to your vendor account so that you don’t have to pay manually. You can choose from ACH payments, fund checks, credit cards, etc., or use Corpay Mastercard and extend your cash flow. When you make payments with Corpay One’s automated account payable tool, you will get a better way of receiving, approving, and tracking bills. It scans the whole document automatically and lets you easily upload invoices, bills, and receipts. Customize each step from approval flows to the bill categorization with Corpay One. It integrates with QuickBooks Desktop and QuickBooks Online to sync payments to the accounting system, hence, less manual entry and fewer errors. Whenever you make a payment from Corpay Mastercard, you will get a 1.5% rebate with no annual fee and a 1% rebate on the other purchases. You can set custom spend controls for your team for free. Corpay One provides money laundering and fraud detection to secure your information. It has the highest security standards and identity verification to protect your account and vendors’ information.

Concur

Automate your account payable process with Concur and simplify your tedious work. You can take a short assessment to know how to pinpoint the areas where the breakdowns exist. After the assessment, it gives you a toolkit of resources, advice, and best practices. Accounts payable involves lots of complexities, but with Concur’s automated accounts payable solution, it becomes easier. Now, you can manage and pay your invoices in a timely and organized manner for an accurate payment procedure. In addition, it helps you save time, vendor fees, and resources and reduce human error, paperwork, and lost invoices. Concur uses Optical Character Recognition (OCR) technology to capture invoices electronically. You will get easy-to-use mobile and web-based applications that help you streamline your payable processes. It also integrates with an accounting system or ERP to sync data quickly.

Pipefy

Pipefy provides intelligent workflows for efficient finance teams to achieve better outcomes. Get complete visibility of the operations at a glance and automate your work with approvers, vendors, and colleagues on its cloud platform for a better finance process. Manage a single communication flow with all your stakeholders and automatically update all the statuses through email or a customer portal. With Pipefy, there are negligible chances of errors in your payment processes. Integrate Pipefy with your financial tools, such as spreadsheets and ERP, to get a better outcome. Additionally, you can measure, control, and enhance your numbers, from each department’s monthly spending to the complete PO cycle time with Pipefy’s customizable dashboards. No need to write a single line of code; tailor Pipefy according to your needs and simplify your account payable process. Gain efficiency and better results by optimizing the finance process and easily monitor your operation on your screen. Why late? Try Pipefy today.

Stampli

Take control over your invoice and bill processing with an intuitive, actionable, and smart account payable automation platform. Stampli brings accounts payable documentation, communications, check payments, ACH payments, and corporate credit cards together under a single roof. Allow Stampli AP to have full visibility and control over your corporate spending. Let AP departments communicate and collaborate better with vendors, stakeholders, and approvers involved with approvals and purchases. Streamline all your financial processes 5 times faster. Stampli uses Artificial Intelligence technology to automate AP invoice processing and learn your unique patterns to automate approval notifications, simplify GL coding, identity duplicates, and more. Get a perfect view of your bill activities, ownership, and statuses with greater accountability and transparency. Stampli offers accurate and real-time invoice capture as well as coding. It also allows your business to scale and keep pace with change. Stampli’s easy-to-use interface allows you to manage your payment processes from any device, anywhere, at any time. It has various capabilities, such as smart AP processing, segregation of duties, full visibility, fast implementation, payment agnostic, and more.

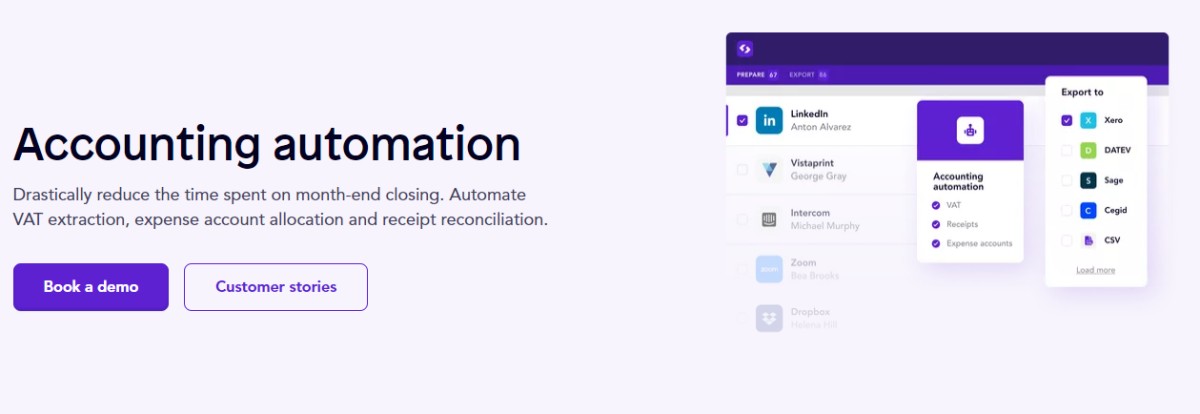

Spendesk

Automate expense account allocation, VAT extraction, and receipt reconciliation with Spendesk and reduce your time spent on your month-end closing. You can access all the payment information in a single place, reducing the sign of error. Spendesk ensures data accuracy and automates your business payment processes thanks to its OCR and pre-setting options. No need to ask for the receipt from your finance team again and again. Find all the receipts in one place. Integrate your accounting software with Datev, Sage, NetSuite, Xero, and more to sync and manage data easily. Spendesk sends reminders automatically to your team for the payment and receipt. You can also map your expenses by creating your own rules with Spendesk payment categories to save time. You can prepare and sort your transactions, export them to your accounting software, and verify information with the Expense Inbox interface. Let Spendesk help your teams to succeed with mobile and web-based applications. It’s time you switch to trackable and smart spending with Spendesk. Book a demo now and understand its impact on your organization.

Conclusion

Keeping track of your dues is a crucial factor. It helps build your reputation and take your business to new heights. Thus, a business must manage its accounts payable efficiently and effectively. Since handling such tasks is tedious and overwhelming, employing an account payable automation solution is obviously a wiser decision. All the AP tools mentioned above are remarkable in their own places. They provide an intuitive interface, never-ending features, and integration options and work for small and large enterprises. Thus, choose the best AP tool based on your requirements. You may now look at some of the best payment processing solutions.